reduced paid up insurance example

For the sake of an example lets assume you have a policy with a 100000 death benefit an accrued cash value of 35000 and that you have thus far paid aggregate premiums of 25000. Basically when the policy acquires this paid-up value it will be known as a paid-up insurance policy.

Acord Insurance Certificate Template 11 Templates Example Templates Example Certificate Templates Certificate Of Achievement Template Templates

While all three factors come into play in many cases the death benefit of your reduced paid-up life insurance will equal the cash value you had accrued.

. A paid-up insurance policy is one where the policyholder stops premium payment but continues to enjoy insurance coverage. We cover special considerations of paid. One of those options is reduced paid-up insurance which ends your obligation to pay premiums but leaves you with coverage in place.

This type of insurance is usually less expensive but still provides value for your. Paid-up additional insurance is additional whole life insurance that a policyholder purchases using the policys dividends. A paid-up policy is an excellent alternative to a savings account with the potential to earn between four and five percent interest on the money invested.

You can use this formula to calculate the reduced paid-up value for LIC policy. It has built up significant cash value over this timearound 50000. Reduced paid-up insurance is a nonforfeiture option that allows the policy owner to receive a lower amount of fully paid whole life insurance excluding commissions and expenses.

If you choose this option its important to realize that the death benefit protection you receive. Reduced paid-up insurance turns your policys cash value into your guaranteed death benefit when you no longer want to pay premiums. Reinsurance will be reduced by the full amount of the reduction.

For example you may take out a whole life policy for 50000. The sum assured in such cases reduces to a value based on the number of premiums paid till date. If you are facing financial problems you may want to consider a reduced paid-up policy.

Reduced paid-up insurance example. Policy tenure 10 years. Paid-up additional insurance is additional whole life insurance coverage that a policyholder purchases using the policys dividends instead of premiums.

Paid-up additional insurance is. If any policy reinsured under this Agreement is changed to Reduced Paid-Up Insurance the net amount at risk reinsured will be adjusted as appropriate and reinsurance will b. Ups And Downs Of Reduced Paid Up Insurance The Ups.

Number of paid premiums 5. If you choose the reduced paid-up life insurance option the. If you had 50000 in cash value for example your reduced paid-up coverage may come with a 50000 death benefit.

For example assume you have a policy you have paid 2500 in premiums each year for 20 years which has a cash value of 40000. Alternatives to reduced paid-up life insurance. Its when you take your whole life insurance policys accumulated cash value and use it to buy a new life insurance policy with a smaller face value.

If your policy has a non-forfeiture clause you may options to get full or partial. If the original policy lapses and reduced paid -up insurance is elected under the terms of the policy the amount reinsured will be reduced. Suppose you purchased a whole life policy seven years ago with a death benefit of 200000.

That reduced amount is based on the cash value at the time you stop the policy. Reduced paid-up insurance allows you to stop paying life insurance premiums. Another way to cut insurance costs is to request a reduced paid-up policy jw2019 There are five dividend options to choose from.

Assume you have a policy with a cash value of 2500 that you have paid 2500 in premiums for the past 20 years if you select for the decreased paid-up life insurance option the assured death benefit will most likely be around 40000 and you will no longer be responsible for future premiums. If your need for coverage changes in the future you may be able to use your dividends and any available cash value to purchase a portion of your coverage and thereby reduce your future premium payments. Initial sum assured x Total premiums paid Cumulative premiums that need to be paid in the plan Reduced paid-up value.

Reduced paid-up insurance allows the death benefit to remain in place without you being required to. Example of the reduced paid-up policy process. In exchange for no longer having to pay premiums the life insurance gives you a reduced amount of life insurance.

Convert to reduced paid-up insurance. The reinsurance premiums will be calculated in the same manner as reinsurance premiums were calculated on the original policy. Reduced paid-up insurance is one of the payout options found in a life insurance nonforfeiture clause.

Essentially reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. Cash Applied to Payment of Premiums Accumulate with Interest Purchase Paid Up Additional Insurance and Reduce Existing Loans. Termine the amount of reduced paid-up insurance.

The attained age of the insured will determine the face value of the new policy. Using the example listed above if the policy owner of a whole life policy that covered an insured for 10000 had a cash reduced from 10000 to 5962. However this coverage would remain in force for the insureds lifetime.

Debt Payment Plan Template Lovely Free Debt Reduction Calculator For Excel How To Plan Word Template Debt Snowball Spreadsheet

Practical Completion Certificate Template Jct 1 With Regard To New Jct Practical Completion Certificate Templat Certificate Templates Templates Best Templates

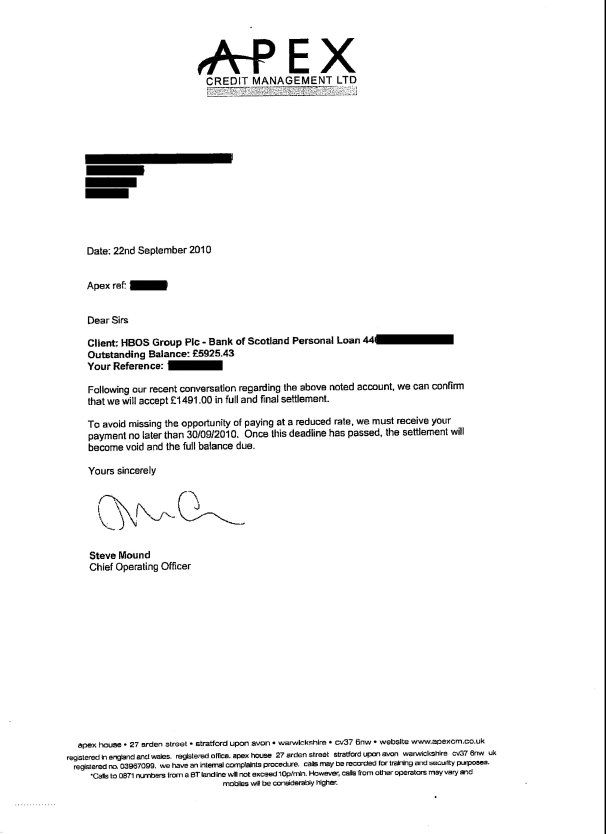

Debt Settlement Services Wipe Clean A Portion Of Balances Save Big Debt Settlement Letter Templates Lettering

Editable Domestic Helper Salary Receipt Template Excel Sample Receipt Template Being A Landlord Templates

Mortgage Settlement Statement How To Create A Mortgage Settlement Statement Download This Mortgage Settleme Statement Template Good Faith Estimate Templates

Financial Hardship Letters And How To Make It Impressive To Read Check More At Http Moussyusa Com Financial Hardship Letters Lettering Resume Homeowner

Explore Our Sample Of Information Needs Analysis Template Analysis Cash Management Financial Analysis

Previous Work Experience Examples For A Resume Resume Job Resume Template Job Resume

Job Reference Letter Template Seven Precautions You Must Take Before Attending Job Reference Cover Letter Template Resume Examples Letter Templates

Check More At Https Gotilo Org Letters Support Letters Charity Care Letter Of Support Support Letter Letter Sample Financial Assistance

Printable Sample Settlement Letter Form Letter Templates Letter Form Legal Forms

Best Statement Of Purpose Examples 100 Free Education Templates Business Template Graduate School

Free Charity Care Letter Of Support Template Google Docs Word Apple Pages Template Net Lettering Support Letter Charity

Lic S Delhi Jeevan Lakshya Table 833 Details Benefits Bonus Calculator Review Example Call 919560214 Life Insurance Corporation Participation Life Insurance

Car Insurance Template Elegant Free Fake Auto Insurance Card Template Car Safety Dannybarrantes Template In 2022 Progressive Insurance Car Insurance Card Template

Explore Our Example Of Web Development Quotation Template Web Design Quotes Estimate Template Quote Template

Certificates Of Insurance What They Are How They Work Certificate Templates Liability Insurance Certificate

Sample Breach Of Settlement Agreement Damages Inspirational 17 Workers Compensation Settlemen Resume Examples Resume Objective Resume Writing Services

Comments

Post a Comment